An employee receiving financial support from their company to pay for moving costs when they relocate for work is known as a relocation allowance. The goal of this support is to lessen the financial strain of moving, which includes expenses for everything from Packers and movers in Hyderabad, travel and temporary housing to transporting personal goods.

It’s important to consider long-term effects in addition to short-term financial assistance, especially with regard to income tax and tax exemptions. An informed worker may use the allowance wisely and facilitate a more seamless transition for them personally and financially.

Expenses Covered Under Relocation Allowance in India

- Packing and moving cost

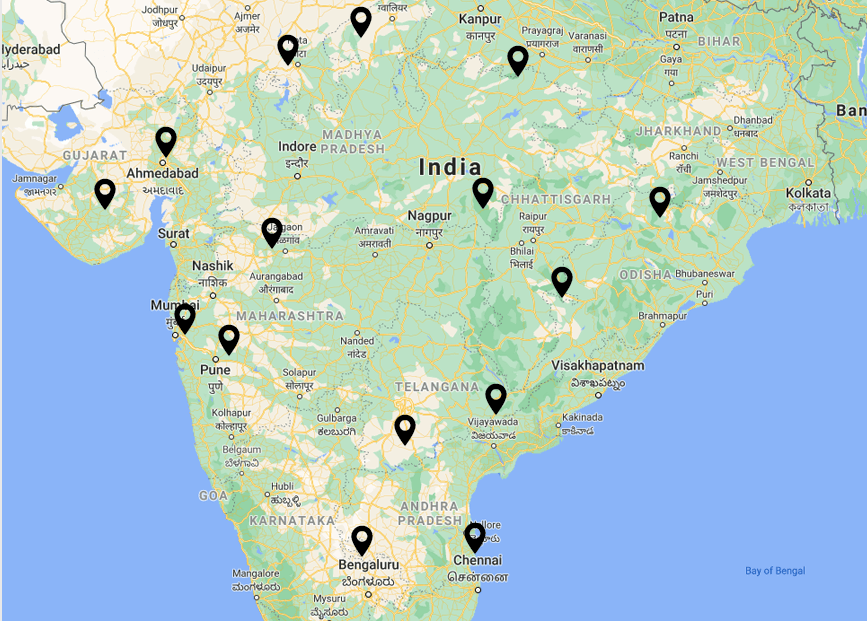

This is frequently the biggest expense of any move procedure. The expenses of hiring Packers and movers in Secunderabad or any other city to securely move an employee’s personal things from their previous home to their new one are typically covered by relocation allowances. This can cover the price of handling fees, packing supplies, and actual item shipment.

- Temporary accommodation

Employees may require interim accommodation while they are at the new location until they find a permanent home. During this transitory time, short-term rentals or hotel stays are frequently covered by relocation allowances.

- Travel expenses

This includes the price of transportation from the previous location to the new one. If the staff member is driving alone, it may cover petrol, airfare, or rail tickets. Meals and other unforeseen costs associated with the trip are also covered by certain companies.

- Other expenses

The relocation allowance may also cover other costs, such as storage fees for personal belongings, costs for locating new housing (such as real estate agent fees), and occasionally even costs for settling into the new location, such as child care or language lessons in the event of an overseas shift, subject to company policy.

Policies of companies on relocation allowances

- Determining the allowance

Businesses frequently begin by determining the particular requirements of the move. This may depend on the employee’s family circumstances, the cost of living in the new place, and the distance of the transfer. While some businesses choose to provide individualised relocation packages based on each employee’s unique situation, others offer standard relocation packages that apply to every employee.

- Common policies and condition

Policies often outline which workers qualify for relocation benefits, frequently taking into account variables including position, tenure, and type of move. Multiple levels of management and HR are usually involved in the approval process for Home shifting services allowances in order to make sure the payment is reasonable and within policy bounds.

Eligibility criteria

- Eligibility is frequently based on the employee’s position within the organisation. Benefits related to relocation may be more likely to be awarded to higher-level staff members or those in crucial positions.

- The reason behind the move—such as a transfer, promotion, or taking a new job offer from the organisation—may also affect eligibility.

- Certain organisations have job requirements that must be met before an employee is qualified for relocation assistance.

- There may be a minimum distance that must pass before a move is accepted for the allowance.

Process to claim allowance

- An offer to relocate is typically made to the employee at the beginning of the process; the terms and conditions should be thoroughly examined.

- For the relocation allowance, employees usually have to file a formal request or application that includes information about the anticipated costs and other pertinent factors.

- After reviewing the request, the relevant management or HR staff decides whether to approve or reject the claim based on budgetary constraints and corporate policy.